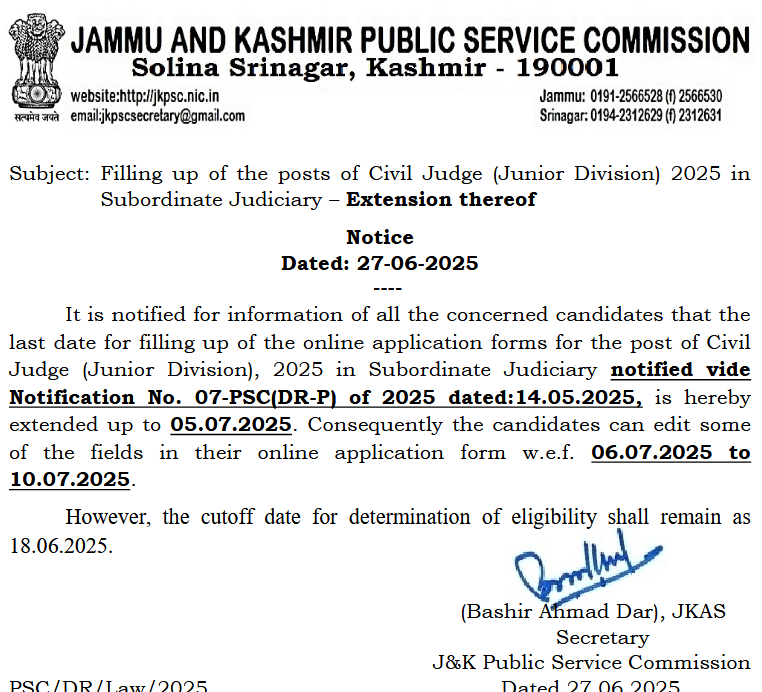

Now Reading: Investors flock to thematic funds, But SIP stability wobbles under sector rush: MIRA Money’s Mohit Bagdi

-

01

Investors flock to thematic funds, But SIP stability wobbles under sector rush: MIRA Money’s Mohit Bagdi

Investors flock to thematic funds, But SIP stability wobbles under sector rush: MIRA Money’s Mohit Bagdi

India’s mutual fund industry is riding a wave of optimism as monthly SIP (Systematic Investment Plan) inflows recently crossed Rs 26,000 crore, underscoring the growing faith of investors—from small retail participants to high-net-worth individuals—in the country’s long-term growth story. Yet, beneath the headline numbers, experts caution that an emerging trend in investor behavior could pose new risks for portfolios built through SIPs.

“SIPs are a powerful tool for long-term wealth creation, but their impact depends entirely on how capital is allocated,” says Mohit Bagdi, Head of Investment Research and Founding Member of MIRA Money. “Chasing overheated themes based on recent returns can do more harm than good. The real discipline lies in staying diversified, avoiding herd mentality, and thinking long-term—even when markets test your patience.”

Over the past four to five years, SIPs have become synonymous with disciplined investing, helping investors navigate volatile markets and cultivate wealth steadily. However, Bagdi notes a sharp change in where this SIP money is flowing.

Between May 2024 and May 2025, the industry saw a striking 32% jump in new sectoral and thematic fund launches across all equity categories. As a result, the number of folios in sectoral and thematic funds surged over 50%, outpacing growth in traditional categories like largecap funds (up 15%) and flexicap funds (up 25%). Sectoral and thematic folios have now crossed 3 crore, overtaking the combined total of largecap, focused, and value funds. Midcap folios, meanwhile, have also seen significant growth, climbing 45% in the same period.

This sudden surge in sector-focused investments mirrors recent stock market rallies in specific pockets of the economy—such as public sector undertakings (PSUs), defence, infrastructure, manufacturing, and newer strategies like momentum and quant-based funds. These segments delivered stellar returns over the past two to three years but have also been prone to sharp corrections in calendar year 2025.

Bagdi warns that many retail investors are chasing past performance, moving money into sectors that have already seen substantial appreciation, rather than following a diversified, long-term strategy. “The real risk isn’t just entering overheated themes,” he explains, “but what happens next—panic redemptions at the worst possible time.”

Evidence of this anxiety is already surfacing in industry data. From April 2021 to October 2024, monthly SIP inflows grew at an impressive pace of around 2.5%. However, growth slowed dramatically to just 0.4% between November 2024 and May 2025—a sign of rising SIP stoppages and increased market volatility.

Direct investing platforms, where investors manage their own SIPs, have also witnessed this turbulence. The SIP stoppage ratio—the measure of how many SIPs were halted relative to those started—has worsened sharply. It rose from 68% in 2023 and 63% in 2024 to a peak of 102% in 2025, meaning more SIPs were stopped than started.

“At a time when investor resilience is most needed, this tendency is alarming,” Bagdi observes. He urges investors to stay grounded in fundamentals, diversify across sectors, and resist the temptation of chasing short-term fads.

While India’s SIP story remains a bright spot in personal finance, Bagdi’s message is clear: sustainable wealth creation demands discipline not only in investing regularly—but also in choosing where that money goes.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Reddit considers iris scan, so users can prove they’re human

01Reddit considers iris scan, so users can prove they’re human -

02As cult characters enter public domain, new stories emerge

-

03“This weakness will pass:” Arthur Hayes on BTC’s slide under $100k

03“This weakness will pass:” Arthur Hayes on BTC’s slide under $100k -

04Nora Fatehi questioned for 6 hours in Rs 200-crore extortion case against conman Sukesh Chandrashekhar

04Nora Fatehi questioned for 6 hours in Rs 200-crore extortion case against conman Sukesh Chandrashekhar -

05Samsung Smart Monitor M9 With QD-OLED Display, AI Features Launched Alongside Updated M8 and M7 Models

05Samsung Smart Monitor M9 With QD-OLED Display, AI Features Launched Alongside Updated M8 and M7 Models -

06Xiaomi Mix Flip 2, Redmi K80 Ultra Launch Date Confirmed; Xiaomi Pad 7S Pro, Redmi K Pad to Debut Alongside

06Xiaomi Mix Flip 2, Redmi K80 Ultra Launch Date Confirmed; Xiaomi Pad 7S Pro, Redmi K Pad to Debut Alongside -

07Jennifer Lopez performs in plunging fringe bodysuit at Riyadh event, netizens slam ’double standards’ in Saudi Arabia